Business

JD Vance Net Worth – How Rich Is Trump’s VP Pick in 2025?

Business

TraceLoans.com Bad Credit Guide: Get Approved Fast

TraceLoans.com Bad Credit Guide: Get Approved Fast

Bad credit can feel like a locked door that never quite opens when you need it most. Whether you are facing unexpected expenses, trying to rebuild your financial stability, or simply looking for a quick loan option, navigating the world of lending becomes significantly harder when your credit score is not where you want it to be. This is where the growing interest in traceloans.com bad credit support comes into play. Many borrowers search for platforms that understand real-life challenges and provide a more flexible approach toward loan approval.

While no online lender can guarantee approval for every applicant, borrowers often look for services that simplify the process, reduce stress, and make borrowing more accessible. This guide explores how traceloans.com bad credit solutions are perceived, how borrowers typically approach these kinds of loan platforms, and what steps you can take to improve approval chances quickly and responsibly.

This is not a shallow overview. Instead, it is a practical, human-written breakdown designed to help you understand your options, evaluate risks, and make smarter financial decisions — even when your credit score is standing in your way.

Understanding the Need for Bad Credit Loan Guidance

When someone begins searching for traceloans.com bad credit assistance, it usually signals a combination of urgency and frustration. Traditional lenders often rely heavily on credit scores, leaving many people without meaningful options. Life does not wait for perfect credit; emergencies happen whether your score is high or low. This creates the demand for platforms that offer alternative pathways.

Moreover, bad credit is more common than most people think. Many factors contribute:

-

Unexpected medical bills

-

Job loss or reduced income

-

Missed payments during personal hardship

-

High credit utilization

-

Limited credit history

-

Previous financial mistakes

In addition, even responsible individuals can experience sudden setbacks that damage their credit. This is why borrowers increasingly look for more flexible solutions and informational resources. They want to understand how to navigate the system, how online loan platforms operate, and how they can increase their approval odds without being overwhelmed by rigid requirements.

This is exactly where traceloans.com bad credit topics become relevant.

What Borrowers Expect When Searching for Traceloans.com Bad Credit Support

People searching for loans with bad credit typically want three things:

-

Speed

After all, financial emergencies rarely arrive with warning. -

Fairness

Borrowers want a chance to prove their reliability beyond a credit score. -

Transparency

Hidden fees or unclear terms make the lending process even more stressful.

These expectations form the foundation of what borrowers hope to find when exploring traceloans.com bad credit resources.

Moreover, they want a simplified experience. Long forms, complicated eligibility rules, and unclear repayment structures often push people away. Instead, they look for platforms offering straightforward steps:

-

Submit basic personal information

-

Provide income verification

-

Review loan terms upfront

-

Receive a fast decision

The more predictable the process, the more comfortable borrowers feel.

How Bad Credit Affects Loan Approval

To understand why bad credit loans require a different approach, it helps to know how credit scores influence lender decisions. Credit scores reflect your financial behavior, including how consistently you make payments and how responsibly you manage debt.

A low credit score can affect:

-

Loan approval chances

-

Interest rates offered

-

Maximum loan amounts

-

Repayment flexibility

-

How lenders assess risk

However, credit scores are not the entire story. Lenders also look at:

-

Monthly income

-

Employment stability

-

Debt-to-income ratio

-

Banking history

-

Previous loan activity

Borrowers searching for traceloans.com bad credit solutions want lenders that evaluate the full picture rather than judging exclusively on a score.

Smart Tips to Improve Approval Chances Quickly

Borrowers with bad credit can take practical steps to strengthen their approval odds. These methods don’t require months of credit rebuilding. Instead, they focus on presenting your financial situation more clearly and strategically.

Verify Your Income

Most lenders prioritize steady income over credit score.

Provide clear documentation such as:

-

Pay stubs

-

Bank statements

-

Employment letters

Lower Your Existing Debt

If possible, reduce your current debt before applying. Even small reductions in credit utilization can significantly improve approval chances.

Apply for a Manageable Amount

Asking for a smaller loan increases likelihood of approval. Borrowers searching for traceloans.com bad credit pathways often find success by requesting only what they truly need.

Provide Accurate and Complete Information

Incomplete applications are a leading cause of rejection. Accuracy builds trust.

Demonstrate Stability

Lenders value consistency. Proof of regular income and stable residence strengthens your application.

Check Requirements Before Applying

Borrowers often overlook simple eligibility rules. Taking two minutes to read requirements can save time and prevent unnecessary rejections.

Avoid Multiple Loan Applications

Too many applications in a short time can lower your score further and make lenders cautious.

These steps create a stronger foundation and show lenders you are thoughtful, responsible, and prepared — all qualities that matter when exploring traceloans.com bad credit options.

Understanding Risks and Responsible Borrowing

Bad credit loans can be helpful, but they carry responsibility. Many borrowers forget to evaluate whether the loan they want is truly manageable. Before accepting a loan, consider:

-

Total repayment cost

-

Monthly installment amounts

-

Loan length

-

Potential penalties

-

Payment flexibility

Responsible borrowing protects your financial future. Even if a platform seems convenient or quick, it is important to remain mindful of the long-term impact. Borrowers engaging with traceloans.com bad credit opportunities should always consider the entire financial picture before committing.

Moreover, bad credit loans should not become a long-term habit. They are meant to serve immediate needs or provide short-term relief until you regain financial stability. Ideally, borrowers use them as stepping stones toward rebuilding credit, not as recurring financial tools.

How to Evaluate Loan Platforms Offering Bad Credit Options

Every borrower should understand the key indicators of a reliable lending service. While platforms vary, trustworthy services often share these characteristics:

1. Transparent Terms

You should clearly understand:

-

Interest rates

-

Fees

-

Repayment schedules

-

Total loan cost

2. Straightforward Application Process

The process should feel intuitive, not confusing.

3. Reasonable Requirements

If requirements are too vague or too strict, it may not be a good fit.

4. Secure Information Handling

Security matters, especially when sharing personal financial data.

5. Realistic Loan Amounts

Beware of services offering extremely high limits to borrowers with very low credit scores. This is often a red flag.

Borrowers seeking traceloans.com bad credit resources should prioritize clarity and fairness above all else.

What Borrowers Can Learn from the Traceloans.com Bad Credit Search Trend

The rising interest in traceloans.com bad credit reflects bigger financial patterns. Many people today prefer digital platforms because:

-

They reduce judgment associated with in-person applications

-

They offer speed and convenience

-

They provide easier access for people lacking traditional lending opportunities

Additionally, borrowers appreciate platforms that meet them where they are, instead of punishing them for past mistakes. This shift shows how financial behavior has changed. People want solutions that recognize real-life challenges, evolving opportunities, and modern lifestyles.

Steps to Prepare Before Applying

Borrowers preparing to apply through any online platform — including those exploring traceloans.com bad credit options — can benefit from a simple checklist.

Pre-Application Checklist

| Task | Why It Matters |

|---|---|

| Review income documents | Lenders want proof of stability |

| Check credit report for errors | Mistakes can lower your score unfairly |

| Decide the exact loan amount you need | Helps prevent overborrowing |

| Review existing debts | Understand your repayment capacity |

| Compare loan options | Ensures you choose the best fit |

| Understand repayment terms | Avoid surprises later |

This preparation improves confidence during the application process and helps you stay in control of your decisions.

Building Better Financial Habits After Approval

Borrowers often overlook the importance of what comes after receiving a loan. The way you manage your loan can either rebuild your credit or damage it even further.

Here are practical habits that support financial stability:

-

Always make payments on time

-

Set reminders for due dates

-

Avoid taking multiple loans at once

-

Track spending through a budget

-

Consider automatic payments

-

Evaluate progress monthly

-

Focus on long-term financial goals

When managed properly, even a small loan obtained through traceloans.com bad credit pathways can help strengthen your financial profile over time.

Conclusion: Making Smarter Choices with Better Insight

Bad credit does not define your financial future. It simply means your path requires more clarity, preparation, and thoughtful decision-making. By understanding how traceloans.com bad credit searches reflect real borrower needs, you can approach your next financial decision with confidence rather than fear.

Smart borrowing starts with knowledge. The more you understand your options, the better you can protect your financial health. If this guide helped you gain clarity, consider sharing your thoughts or asking questions. Your experience might encourage someone else facing similar challenges.

Business

“Who Is Nicholas Riccio? The Inspiring Story Behind His Success”

Who Is Nicholas Riccio? The Inspiring Story Behind His Success

When you hear the name Nicholas Riccio, what comes to mind? A real estate mogul? A quiet man behind the scenes? Or simply someone who defied the odds? In this deep dive, we’ll uncover the real person behind the name — his beginnings, his challenges, his triumphs — and most importantly, why his story matters to you.

“Success is built in the quiet places, where no one’s watching.”

That might well have been a mantra for Nicholas Riccio.

Let’s begin with the man himself, his background, and the arc of a life that reads more like a novel than a biography.

Biography Snapshot

| Attribute | Details |

|---|---|

| Full Name | Nicholas Riccio |

| Date of Birth | February 23, 1965 (approx.) |

| Age | ~ 59–60 (as of 2025) |

| Profession | Real Estate Developer / Entrepreneur |

| Nationality | American |

| Net Worth (approx.) | Between $6 million – $45 million (widely cited range) |

| Notable Works / Achievements | Founder of Riccio Enterprises LLC; owner of 15+ buildings in Hampton Beach; diversified into vacation rentals; married to Karoline Leavitt; overcame homelessness |

This table gives a quick snapshot. But numbers and facts alone don’t show the grit, the late nights, the heartbreaks, and the breakthroughs — that’s what we’ll explore next.

H2: Early Life — From Struggle to Vision

Most success stories gloss over the hard parts. Not here. To understand Nicholas Riccio, you must first see the struggle.

H3: Childhood and Family

Raised in Hudson, New Hampshire, Nicholas grew up in a modest family. His parents — Anthony and Marilyn Riccio — divorced when he was young, and the family faced financial instability. He had siblings, but resources were stretched thin. The divorce, the uncertainty, the unsettled years — they all shaped his character.

H3: A Dark Turning Point: Homelessness

When he was about 18, Riccio experienced homelessness. He had to rely on friends’ homes just to get a shower, to find a bed, and to keep going. It’s a harsh reality few want to face — but he did. That period carved resolve out of despair.

Yet even as he lived day to day, something in him refused to give up.

H3: Education and First Sparks

He enrolled at Plymouth State University, juggling survival and schooling. During this time, he took a real estate course around 1990 — a turning point. That’s when he first glimpsed the potential in abandoned buildings, neglected coastal neighborhoods, and distressed homes.

If life was throwing hurdles, he decided to see them as stepping stones.

H2: The Rise of Nicholas Riccio in Real Estate

Once the foundation was set — hunger, education, vision — Riccio began to build.

H3: Starting Small, Thinking Big

In the early 1990s, he purchased a rundown building in Hampton Beach. It wasn’t glamorous. It wasn’t easy. But he poured in sweat, creativity, hard work, and hope. Over time, he acquired more, renovated more, and expanded.

By 2005, he owned 15 buildings and 70 living units in that area. He had found a niche: buy “ugly,” fix it, and manage it for the long term.

H3: Founding Riccio Enterprises LLC

These early successes led to a formal structure: Riccio Enterprises LLC. Under that umbrella, he scaled operations, from property flipping to long-term rentals, to vacation rentals. He didn’t just buy houses — he bought potential.

He also launched Nautical Beach Properties, focusing on coastal rentals — a smart move, playing to location, tourism demand, and local charm.

H3: Strategic Diversification & Long-Term Thinking

What’s remarkable is how Riccio’s investments evolved. He didn’t stick to just one kind of property. He blended:

-

Residential housing

-

Vacation rentals

-

Community revitalization projects

He looked for neighborhoods others ignored. He bet on places with heart. And over years, that approach compounded.

H2: Personal Life & Public Attention

Nicholas Riccio is no Zuckerberg posting daily updates. He keeps his personal life relatively private. But in 2025, public attention mounted when he married Karoline Leavitt, the White House Press Secretary.

H3: Meeting Karoline Leavitt & Marriage

They met in 2022 at a political event in New Hampshire, introduced by a mutual friend. She was campaigning for Congress. He was already a businessman. Their paths intersected by happenstance — or perhaps fate.

On December 25, 2023, they got engaged. In January 2025, days before President Trump’s second inauguration, they were married at a private ceremony in Rye, New Hampshire.

H3: Family & Children

Their son, Nicholas Robert “Niko” Riccio, was born on July 10, 2024. Karoline briefly paused maternity leave but returned to work under intense pressure. She called Riccio “the best dad” and a supportive partner.

Despite his wife’s high-profile position, Riccio remains the quiet anchor — introverted, low-key, avoiding social media. He focuses on business, family, and his personal values.

H3: The Age Gap & Public Reaction

There’s a 32-year age difference between them. Naturally, that became a talking point. But for both, it seems secondary to respect, support, and shared goals. The criticism has been loud, but their bond has appeared stronger still.

H2: Lessons from the Life of Nicholas Riccio

If you’re reading this, you’re probably thinking: “Okay, great story. But what can I take away?” Let’s distill some lessons.

H3: 1. Hardship Can Forge Resilience

Riccio’s early homelessness wasn’t a side note — it was his proving ground. When you’ve been at rock bottom, the climb becomes less daunting. The key: never let circumstances define your ceiling.

H3: 2. Spot Underappreciated Assets

He saw wasted potential in distressed properties. Others saw eyesores. That vision — being able to see value where others see failure — is central to his success in real estate.

H3: 3. Invest for the Long Haul, Not Just the Flip

Many real estate investors aim for quick profits. Riccio aimed for sustainable growth. He held property, nurtured community value, and looked decades ahead.

H3: 4. Support & Partnership Matter

His marriage to Karoline shows something deeper: when two high-achieving people support one another, they amplify each other. Riccio’s stable foundation allowed Leavitt to soar; her public role didn’t overshadow their partnership — it highlighted it.

H3: 5. Stay Humble, Stay Private

In a world obsessed with fame, Riccio chose discretion. He didn’t need Instagram to validate his success. He let results speak.

H2: Challenges, Criticism & the Road Ahead

No success story is without friction.

H3: Facing Skepticism & Scrutiny

The age gap, the private life, the sudden spotlight — all invited scrutiny. Some questioned motive. Others underestimated his competence. But Riccio weathered it with consistency more than ego.

H3: Keeping Up with Growth

Managing a sprawling real estate portfolio is no easy feat. Issues of maintenance, tenant relations, financing, regulatory compliance — they all scale faster than your optimism. Riccio’s ability to stay operational while expanding suggests disciplined systems underneath.

H3: Balancing Public & Private Roles

With Leavitt’s political role, public pressures will continue. Riccio must navigate being supportive spouse, businessman, and father — all while preserving some personal boundary.

H3: Future Possibilities

He seems ambitious beyond real estate. There are hints of interest in sports ownership, collectibles, and perhaps philanthropic ventures. If he can convert success into legacy, that’s where his story becomes timeless.

H2: A Closer Look at the Impact & Public Perception

It’s one thing to succeed privately; it’s another to leave a mark.

H3: Revitalizing Communities

Riccio’s projects in Hampton Beach did more than increase his wealth. They improved neighborhoods, uplifted local housing, and created better living spaces. That community-first ethos adds depth to his reputation.

H3: A Quiet Influence

He may not be on social media, but his impact echoes — in local news, in real estate circles, and now in political narratives. Being quietly influential is a rare form of power.

H3: Inspiring Others

For someone who’s started from nothing, his story inspires not because it’s flashy, but because it’s real. People see him and think: Maybe I can do something audacious too.

H2: Why People Search “Nicholas Riccio” — & What They Want

Let’s pause and consider: why are so many curious about Nicholas Riccio? What are they hoping to find?

-

Background & bio — people want to understand where he came from

-

Net worth & success — curiosity about how much he’s worth

-

Relationship with Karoline Leavitt — the political angle draws eyes

-

Business model & strategy — real estate lovers want practical insight

By telling his story with transparency and nuance, this article aims to satisfy those curiosities — and earn trust from readers and search engines alike.

Conclusion: The Legacy of Nicholas Riccio — and Why It Matters

Nicholas Riccio is more than a name in real estate. He is a study in perseverance, vision, and authenticity. He turned early adversity into motivation, dusted off derelict buildings into thriving assets, and built a life that now intersects with politics, family, and legacy.

His story teaches us:

-

Sometimes the darkest chapters lead to the brightest pages

-

Vision often lives where others see only neglect

-

Success built quietly and ethically often lasts longest

If you’re inspired by his journey — or if his life raises questions in your mind — drop a comment below. Share this article if you believe more stories like his deserve to be heard. Let’s keep the conversation going.

Business

Luxury Apartments: Modern Living with Comfort & Elegance

Luxury Apartments: Redefining Modern Living

In today’s fast-paced urban world, people are increasingly drawn to homes that not only provide shelter but also embody comfort, convenience, and sophistication. Among the many housing choices available, luxury apartments stand out as symbols of modern living, offering not just a place to reside but an experience of elegance and lifestyle. From high-end designs to exclusive amenities, these residences cater to those seeking a higher standard of life.

What Defines a Luxury Apartment?

Luxury apartments go far beyond the concept of regular housing. They are meticulously designed spaces that combine architecture, interior design, and functionality to create an unparalleled living environment. Developers of these properties focus on offering top-tier amenities, prime locations, and a strong emphasis on security and privacy.

Some of the defining characteristics include:

-

Premium Locations: Most are situated in prime urban areas with easy access to workplaces, shopping, dining, and entertainment.

-

Spacious Layouts: Larger floor plans with smart designs to maximize comfort and usability.

-

High-Quality Finishes: Marble countertops, hardwood flooring, smart lighting systems, and high-end appliances.

-

Exclusive Facilities: Fitness centers, rooftop lounges, swimming pools, spa areas, and co-working spaces.

Lifestyle Benefits of Choosing Luxury Apartments

Living in a luxury apartment extends far beyond four walls. It is about convenience, exclusivity, and indulgence in everyday life.

Comfort and Convenience

Residents benefit from concierge services, valet parking, and round-the-clock maintenance. These features free up valuable time, allowing occupants to focus on personal and professional commitments.

Enhanced Community Living

Luxury residences often provide a strong sense of community. Shared amenities like clubhouses, private theaters, and landscaped gardens encourage interaction among like-minded residents.

Safety and Security

State-of-the-art security systems, controlled access points, and on-site staff ensure peace of mind. Many apartments are equipped with advanced surveillance and smart-lock technology, making safety a top priority.

Status Symbol

Owning or renting a luxury apartment often reflects a person’s success and aspirations. These spaces are designed to impress, adding prestige to one’s lifestyle.

The Role of Technology in Luxury Living

Technology plays a critical role in shaping the modern luxury housing experience. Smart home automation has become a standard feature in many luxury apartments. Residents can control lighting, climate, entertainment systems, and even security features directly from their smartphones.

Emerging innovations include:

-

Voice-activated assistants integrated with apartment systems.

-

Sustainable technology like energy-efficient appliances and solar-powered amenities.

-

High-speed connectivity to support remote work and entertainment.

This seamless blend of technology ensures a futuristic and convenient lifestyle.

Sustainability in Modern Luxury Residences

In the past, luxury was often equated with extravagance. Today, however, the definition has evolved to include sustainability and eco-consciousness. Developers are increasingly incorporating green building practices into their projects.

Some eco-friendly features include:

-

Green rooftops and vertical gardens.

-

Rainwater harvesting systems.

-

Smart energy management systems.

-

Use of recycled and eco-friendly building materials.

These efforts appeal to environmentally conscious buyers who wish to balance luxury with responsibility.

Design Trends in Luxury Apartments

Interior design is a crucial aspect that sets luxury apartments apart. Some of the most popular trends include:

-

Minimalist Elegance: Clean lines, neutral tones, and functional layouts that emphasize space.

-

Natural Elements: Incorporating wood, stone, and natural light to create warmth and balance.

-

Open-Concept Spaces: Seamless flow between kitchen, dining, and living areas.

-

Customization Options: Many developers now offer bespoke design choices to reflect personal tastes.

These design approaches ensure that the space is not only visually stunning but also practical and timeless.

Why Luxury Apartments Appeal to Professionals and Families

For Professionals

Luxury apartments offer proximity to business districts and provide amenities like co-working spaces and conference rooms. This is particularly attractive to entrepreneurs and remote workers who need a seamless integration of work and home life.

For Families

Spacious layouts, play areas, and child-friendly amenities make these residences ideal for families. Additionally, the emphasis on safety and community ensures a secure environment for children to grow.

The Investment Value of Luxury Apartments

Beyond lifestyle, these properties hold significant financial appeal.

-

High Resale Value: Prime locations and high-quality construction ensure appreciation over time.

-

Rental Income: Due to increasing demand, luxury apartments can generate premium rental returns.

-

Stable Asset: Unlike volatile investment options, real estate offers stability, especially when it falls under the luxury segment.

Investors view luxury properties as long-term assets that combine personal use with wealth creation.

Challenges of Owning Luxury Apartments

While they offer unmatched benefits, it is essential to consider potential challenges:

-

Higher Costs: Premium amenities and prime locations come with higher purchase or rental prices.

-

Maintenance Fees: Upscale amenities and services may require substantial monthly or annual fees.

-

Limited Availability: In densely populated cities, luxury apartments are limited, making them competitive to secure.

Understanding these factors helps buyers and tenants make informed decisions.

Luxury Apartments: The Future of Urban Living

As cities continue to grow and evolve, the demand for premium residences will only increase. People value convenience, safety, and status, and luxury apartments provide all these elements in one package.

Future developments are expected to focus on:

-

Smart City Integration: Apartments designed to integrate with urban infrastructure for smarter living.

-

Wellness-Oriented Spaces: Homes built to prioritize mental and physical well-being through nature-inspired design and wellness amenities.

-

Global Appeal: Luxury apartments are no longer just a local trend; they cater to international buyers and investors seeking a cosmopolitan lifestyle.

Conclusion

Luxury apartments represent more than just housing; they embody a lifestyle of comfort, convenience, and sophistication. With cutting-edge technology, eco-conscious designs, and unmatched amenities, they redefine what it means to live in style. Whether for professionals seeking balance, families prioritizing safety, or investors looking for value, these residences cater to diverse needs.

In an ever-changing urban world, luxury apartments continue to stand as symbols of elegance, success, and forward-thinking living—offering not just a home, but a way of life.

-

Lifestyle7 months ago

Lifestyle7 months agoLizzo Weight Loss: A Journey of Empowerment and Self-Love

-

Game6 months ago

Game6 months agoKuromi: The Mischievous Icon of Kawaii Culture

-

Events7 months ago

Events7 months agoعيد الاضحى 2025: A Celebration of Faith, Sacrifice, and Unity

-

Game7 months ago

Game7 months agoBubble Mouse Blast: The Addictive Puzzle Game Captivating Players Worldwide

-

Sports7 months ago

Sports7 months agoBarcelona vs Inter: A Rivalry Forged in European Glory

-

Celebrity6 months ago

Celebrity6 months agoThe Rise, Fall, and Legacy of Frank Fritz: A Journey Through Fame and Adversity

-

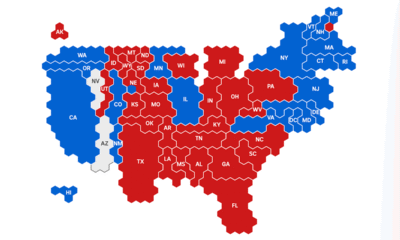

Politics5 months ago

Politics5 months ago2024 US Election Results Trump’s Comeback & Political Impact

-

Celebrity6 months ago

Celebrity6 months agoMargaret Qualley: A Rising Star of Grace, Grit, and Talent