Finance

MSFT Stock Forecast Growth, Insights & Investment Outlook

MSFT Stock A Comprehensive Guide to Microsoft’s Market Power

Introduction

Microsoft Corporation, with the ticker symbol MSFT, stands as one of the most dominant players in the technology industry. Over the past decades, the company has evolved from a software-focused firm to a diversified tech conglomerate involved in cloud computing, artificial intelligence, gaming, and enterprise services. As of 2025, the MSFT stock continues to be one of the most watched and discussed equities in global markets, offering a blend of stability, growth, and innovation that appeals to a wide range of investors.

In this article, we’ll explore the current state of MSFT stock, its performance history, recent developments, investment potential, and long-term outlook. Whether you’re a new investor or a seasoned market analyst, this comprehensive guide offers valuable insights into why MSFT remains a tech stock titan.

Microsoft’s Market Position and Product Ecosystem

Core Business Segments

Microsoft operates across several key segments:

-

Productivity and Business Processes: This includes Office 365, LinkedIn, and Dynamics.

-

Intelligent Cloud: Featuring Azure, SQL Server, Windows Server, and other enterprise cloud services.

-

More Personal Computing: Encompasses Windows OS, Surface hardware, and the Xbox gaming platform.

These diversified operations provide Microsoft with resilient income streams and help stabilize MSFT stock performance, even during economic turbulence.

Innovation and R&D Investment

Microsoft’s commitment to innovation is evident in its massive R&D spending, which topped $27 billion in 2024. The company is deeply involved in artificial intelligence through initiatives like Copilot, its integration of OpenAI’s GPT models into productivity tools, and the expansion of its Azure AI services. These forward-looking investments are vital to MSFT stock’s long-term growth trajectory.

Financial Performance and Recent Earnings

Revenue and Profit Trends

Microsoft’s fiscal 2024 earnings report showed strong growth, with revenue reaching over $250 billion. Azure cloud services grew by nearly 24% year-over-year, while Office 365 and LinkedIn continued to perform robustly.

-

Net income: $88 billion

-

Earnings per share (EPS): $11.15

-

Operating margin: 42%

These solid financials contribute significantly to investor confidence and the consistent upward momentum in MSFT stock valuations.

Dividend and Share Buybacks

Microsoft pays a quarterly dividend, which has increased consistently over the years. As of 2025, the annual dividend yield hovers around 0.85%, which, while modest, is supplemented by share buybacks worth billions each year. These buybacks help enhance shareholder value and support MSFT stock prices.

MSFT Stock in the Market: Technical and Historical Analysis

Historical Price Performance

MSFT stock has delivered extraordinary returns for long-term investors. Since its IPO in 1986, the stock has undergone multiple splits and has consistently grown, particularly since Satya Nadella took over as CEO in 2014.

In the past five years alone, MSFT stock has appreciated more than 130%, outperforming the NASDAQ-100 and other major indices.

Technical Indicators

As of mid-2025:

-

Price: Hovering around $450 per share

-

P/E Ratio: Approximately 32x forward earnings

-

200-Day Moving Average: Strong upward trend

-

RSI (Relative Strength Index): Currently at 63, indicating moderate buying momentum

While valuations remain elevated, MSFT’s earnings growth justifies the premium investors are willing to pay.

Key Growth Drivers for MSFT Stock

Cloud Computing and AI

Azure continues to be Microsoft’s crown jewel. With enterprises rapidly migrating to the cloud, Azure is capturing significant market share, trailing only Amazon Web Services (AWS). Microsoft’s integration of AI into Azure and Office platforms adds another layer of differentiation.

The growth of generative AI and Microsoft’s strategic investments in OpenAI have put MSFT stock in the spotlight, especially as productivity tools gain intelligent features that boost enterprise adoption.

Gaming and Consumer Tech

The acquisition of Activision Blizzard, completed in late 2024, has fortified Microsoft’s gaming portfolio. With the success of Game Pass and cloud gaming, the Xbox ecosystem continues to grow. This makes Microsoft a key player in both entertainment and enterprise sectors.

Enterprise and Government Contracts

Microsoft maintains long-term government and corporate contracts globally. Its secure cloud infrastructure and compliance standards make it the go-to provider for high-security clients, which translates into long-term recurring revenue.

Risks and Challenges to Watch

While MSFT stock seems like a bulletproof investment, it is not without risks:

-

Regulatory Scrutiny: Antitrust concerns and regulatory challenges from the EU and US could impact growth, especially regarding acquisitions and cloud dominance.

-

Competition: Microsoft faces fierce competition from Google, MSFT Stock Amazon, and Apple across different verticals.

-

Economic Cycles: While diversified, Microsoft isn’t immune to global recessions or IT budget cuts, which could pressure short-term earnings.

Analyst Ratings and Market Sentiment

Most analysts maintain a “Strong Buy” or “Buy” rating on MSFT stock. According to a consensus from major investment firms:

-

Price target (12 months): $480 – $510

-

Bull case: $550+

-

Bear case: $400

The sentiment remains largely bullish due to Microsoft’s strong fundamentals and leadership in AI and cloud computing.

MSFT Stock and Long-Term Investment Strategy

For Growth Investors

With consistent revenue and profit growth, aggressive R&D, and expanding AI integration, MSFT offers a strong growth story. Its stock performance over the past decade is a testament to its compounding power.

For Dividend Investors

Even though MSFT stock offers a relatively low dividend yield, its consistent dividend growth, large cash reserves, and buybacks make it a viable component in an income-focused portfolio.

For ESG-Conscious Investors

Microsoft scores well in environmental, social, and governance (ESG) criteria. The company has pledged to be carbon-negative by 2030 and has strong internal governance structures. This improves its appeal to a broader class of institutional investors.

Conclusion: Is MSFT Stock a Buy in 2025?

The evolution of Microsoft from a Windows-based software company into a diversified global tech leader has been nothing short of phenomenal. Backed by its strong balance sheet, visionary leadership, and investments in transformative technologies like AI and quantum computing, MSFT stock remains one of the most dependable blue-chip equities in the world.

Finance

Crypto30x.com Review: Can It Really Find 30x Gems?

Crypto30x.com Review: Can It Really Find 30x Gems?

If there is one thing every crypto investor dreams about, it’s discovering the next big project before it skyrockets. The thought of finding a token early, watching it grow, and riding it all the way to massive returns is what keeps the entire market so exciting. It’s also the reason platforms like crypto 30x .com are becoming increasingly popular. They promise to help traders identify high-growth opportunities with the potential to multiply portfolios dramatically. But can a tool really spot 30x gems before the rest of the market notices them?

That question alone is enough to make any investor curious. A platform claiming to detect early-stage altcoins, hidden gems, undervalued tokens, and breakout opportunities needs more than hype to stand out. It needs structure, insight, data, and credibility. In this review, we take a deep look into how crypto 30x .com works, who it’s for, how accurate it is, and whether it truly offers an edge in a market full of noise.

What follows is not just a surface-level overview but a complete, human-written exploration designed to answer the questions traders genuinely ask.

What Is Crypto30x.com?

Before exploring its potential, it’s worth understanding what crypto 30x .com actually offers. At its core, the platform positions itself as an analytical tool built to highlight tokens with high upside potential. It doesn’t rely on random picks or hype cycles. Instead, it uses data-driven insights drawn from indicators such as:

-

Market sentiment

-

On-chain activity

-

Trading volume growth

-

Social metrics

-

Whale movement

-

Community engagement

-

Developer activity

-

Roadmap progress

-

Real utility and token demand

Many traders spend hours attempting to track these factors manually. The idea behind crypto 30x .com is to streamline this process and present opportunities faster, allowing users to make informed decisions while others are still searching.

This is especially important in a fast-moving environment where early identification can mean the difference between a small gain and a career-changing return.

How Does Crypto30x.com Claim to Spot 30x Gems?

While no tool can guarantee a 30x return, platforms like crypto 30x .com rely on patterns observed in previous high-performing coins. Almost every major crypto that surged dramatically shared certain characteristics before its breakout.

These characteristics often include:

-

Rapid growth in community size

-

Increased token utility and adoption

-

Developer transparency

-

Accelerating market interest

-

Consistent volume spikes

-

Strong fundamentals layered with hype

-

Partnerships or ecosystem expansion

Crypto 30x .com appears to combine these factors into its scoring or ranking system. By doing so, it attempts to filter out noise and highlight coins that check multiple boxes. In theory, this helps investors focus on quality instead of endless speculation.

Moreover, the platform incorporates elements of technical and fundamental analysis, both of which have long been used by traders to gauge market potential.

Key Features of Crypto30x.com

H2: Data-Driven Token Rankings

Crypto 30x .com ranks coins based on several performance metrics. These rankings offer a quick overview of which tokens exhibit strong momentum or underlying growth.

H2: Early-Stage Alerts

One of its most attractive features is the early-stage alert system. This aims to capture coins before they trend on major platforms, giving traders a time advantage.

H2: Sentiment Tracking

The platform uses sentiment analysis to gauge whether investors are becoming more optimistic or cautious. Sentiment often shifts before price movement, making it a valuable metric.

H2: Market Intelligence Dashboard

A clean dashboard displays essential data points, allowing users to see everything from trending searches to liquidity movements and volume surges.

H2: Portfolio Watch Tools

Some versions of the platform include tools to monitor your existing portfolio and compare performance with emerging opportunities.

H2: Beginner-Friendly Layout

Even though it uses advanced analytics, the interface is structured simply enough for new traders to understand without feeling overwhelmed.

Who Should Use Crypto30x.com?

While the platform appeals to many types of traders, it serves some groups especially well.

H3: Early-Stage Altcoin Hunters

Investors looking for the next underrated project can use its analytics to find new opportunities before they gain mainstream attention.

H3: Long-Term Crypto Believers

People building long-term portfolios might appreciate tools that highlight utility-driven and fundamentally strong coins.

H3: Day Traders and Swing Traders

Traders who rely on frequent market shifts can use sentiment and volume analysis to identify short-term opportunities.

H3: Crypto Researchers and Analysts

Those who produce reports, content, or market predictions may find the platform valuable for gathering insights quickly.

H3: Newcomers Learning the Market

It’s structured well enough for beginners looking to understand how professional tools analyze coins.

How Accurate Are Crypto30x.com Predictions?

A major concern for any investor is reliability. No crypto platform is perfect, and no analytic tool can guarantee a 30x return. However, the value of crypto 30x .com is not in guaranteeing results but in offering structured research that reduces guesswork.

Accuracy in crypto forecasting typically depends on:

-

Market conditions

-

Global economic shifts

-

Community sentiment

-

Project roadmap execution

-

Liquidity levels

-

Whale activity

Crypto 30x .com does not claim certainty; it offers probability-based insights. When the market behaves normally, data-driven probability tends to outperform emotional decision-making. This makes the platform a supportive tool rather than a magic button.

Strengths and Limitations of Crypto30x.com

Every tool has benefits and weaknesses. Listing them helps investors create realistic expectations.

H2: Strengths

-

Uses data instead of hype

-

Provides fast analysis

-

Helps spot coins before they trend

-

Reduces research time

-

Great for beginners and advanced traders

-

Tracks sentiment and fundamentals together

-

Identifies early momentum patterns

H2: Limitations

-

Cannot guarantee a 30x return

-

Market unpredictability can affect results

-

Users still need proper risk management

-

Doesn’t replace personal research

-

Some metrics may vary depending on API sources

Understanding these pros and cons is essential before subscribing to any platform.

Can Crypto30x.com Really Help You Find 30x Gems?

This is the question everyone wants answered. After exploring the platform’s strategy, features, and methodology, a realistic conclusion emerges: crypto 30x .com is not a guarantee of wealth, but it is a carefully structured tool designed to improve your chances of identifying valuable projects early.

It takes the complexity of crypto research and simplifies it into actionable insights. It reduces emotional trading, improves pattern recognition, and provides data that can support smarter decisions. For investors willing to learn, analyze, and apply risk management, the platform can be a powerful edge.

However, it is not a shortcut. It is a companion tool meant to complement your strategy. Those who treat it as a complete replacement for research may be disappointed. But those who use it as an intelligent extension of their trading approach may discover projects far earlier than the average investor.

This is where its real value lies.

Final Verdict: Is Crypto30x.com Worth Exploring?

After a detailed review, the answer depends largely on your trading mindset. If you value data, prefer structured research, and want to uncover hidden opportunities before they explode, then crypto 30x .com is a tool worth considering. It’s built for individuals who take crypto seriously and want to remove guesswork from their decision-making process.

Moreover, the platform pushes investors to think long-term, analyze fundamentals, and understand market signals. These habits naturally lead to better outcomes, regardless of whether a specific coin reaches a 30x return.

If your goal is to evolve as a trader, increase your knowledge, and strengthen your portfolio strategy, crypto 30x .com can absolutely play a meaningful role in that journey.

Before you leave this page, consider sharing your thoughts about tools like this. Do you rely on analytics, or do you follow instinct? Which approach has helped you more? Your insights could help another trader learn something valuable.

-

Lifestyle8 months ago

Lifestyle8 months agoLizzo Weight Loss: A Journey of Empowerment and Self-Love

-

Game8 months ago

Game8 months agoKuromi: The Mischievous Icon of Kawaii Culture

-

Events8 months ago

Events8 months agoعيد الاضحى 2025: A Celebration of Faith, Sacrifice, and Unity

-

Game8 months ago

Game8 months agoBubble Mouse Blast: The Addictive Puzzle Game Captivating Players Worldwide

-

Celebrity8 months ago

Celebrity8 months agoThe Rise, Fall, and Legacy of Frank Fritz: A Journey Through Fame and Adversity

-

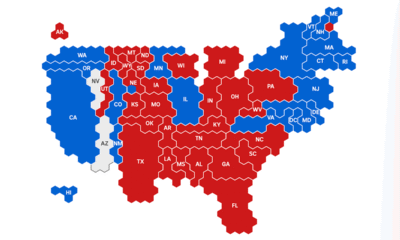

Politics6 months ago

Politics6 months ago2024 US Election Results Trump’s Comeback & Political Impact

-

Sports8 months ago

Sports8 months agoBarcelona vs Inter: A Rivalry Forged in European Glory

-

Lifestyle6 months ago

Lifestyle6 months agoAuggie Savage: Rise, Career Journey, and Inspiring Story